When a Corporation Pays a Note Payable and Interest

They will debit notes payable and interest expense. When carrying out and accounting for notes payable the maker of the note creates liability by borrowing from another entity promising to repay the payee with interest.

Ch01 Solution W Kieso Ifrs 1st Edi

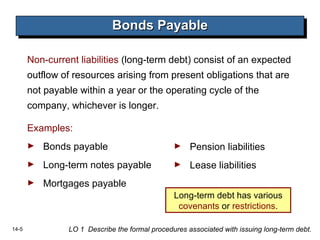

Notes payable can either be short-term or long-term depending on the timing.

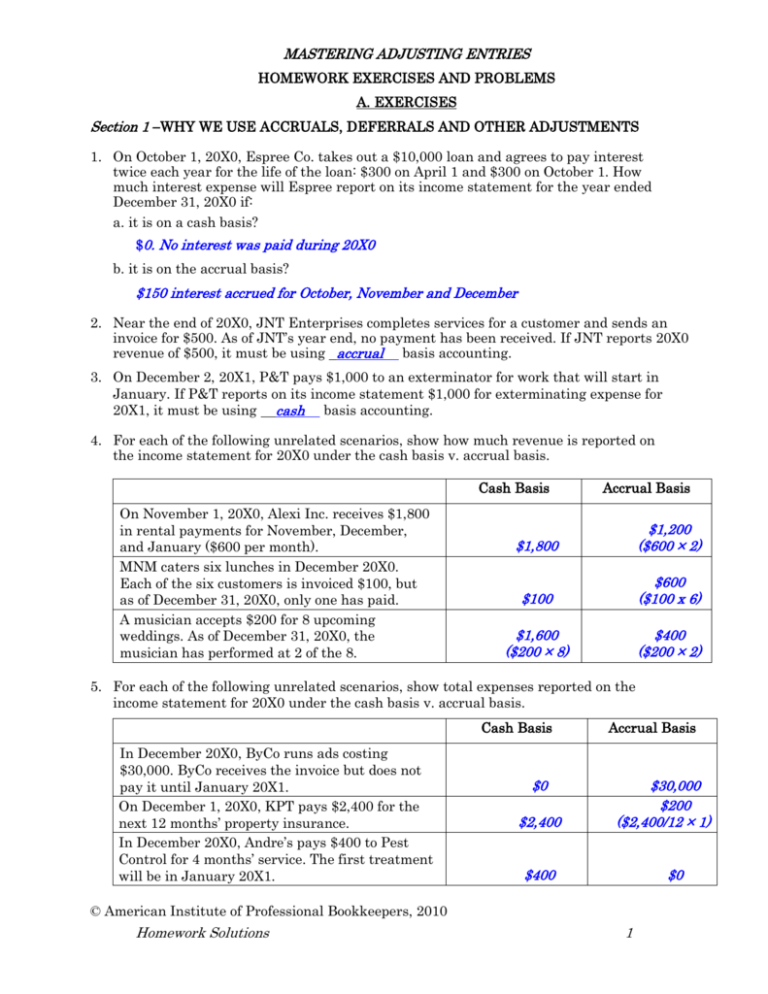

. For example a bank loans ABC Company 1000000. The present value of the notes payable is calculated using the present value formula PV FV 1 i n where FV future value in this case 14600 i the interest rate say 6 and n the term in years in this case 1. ABC records the entry as follows.

The account notes payable will be increased. Short-term notes payable are due within 12 months. Definition of notes payable.

When a corporation pays a note payable and interest a. All of the following accounts are increased on the credit side. The account interest expense will be decreased.

Transcribed Image Text When a corporation pays a note payable and interest Select one. Notes payable and accounts. The company usually issue notes payable to meet short-term financing needs.

Interest is still calculated as Principal x Interest x Frequency of the year use 360 days as the base if note term is days or 12 months as the base if note term is in months. The account notes payable will be increased. The cash amount in fact represents the present value of the notes payable and the interest included is referred to as the discount on notes payable.

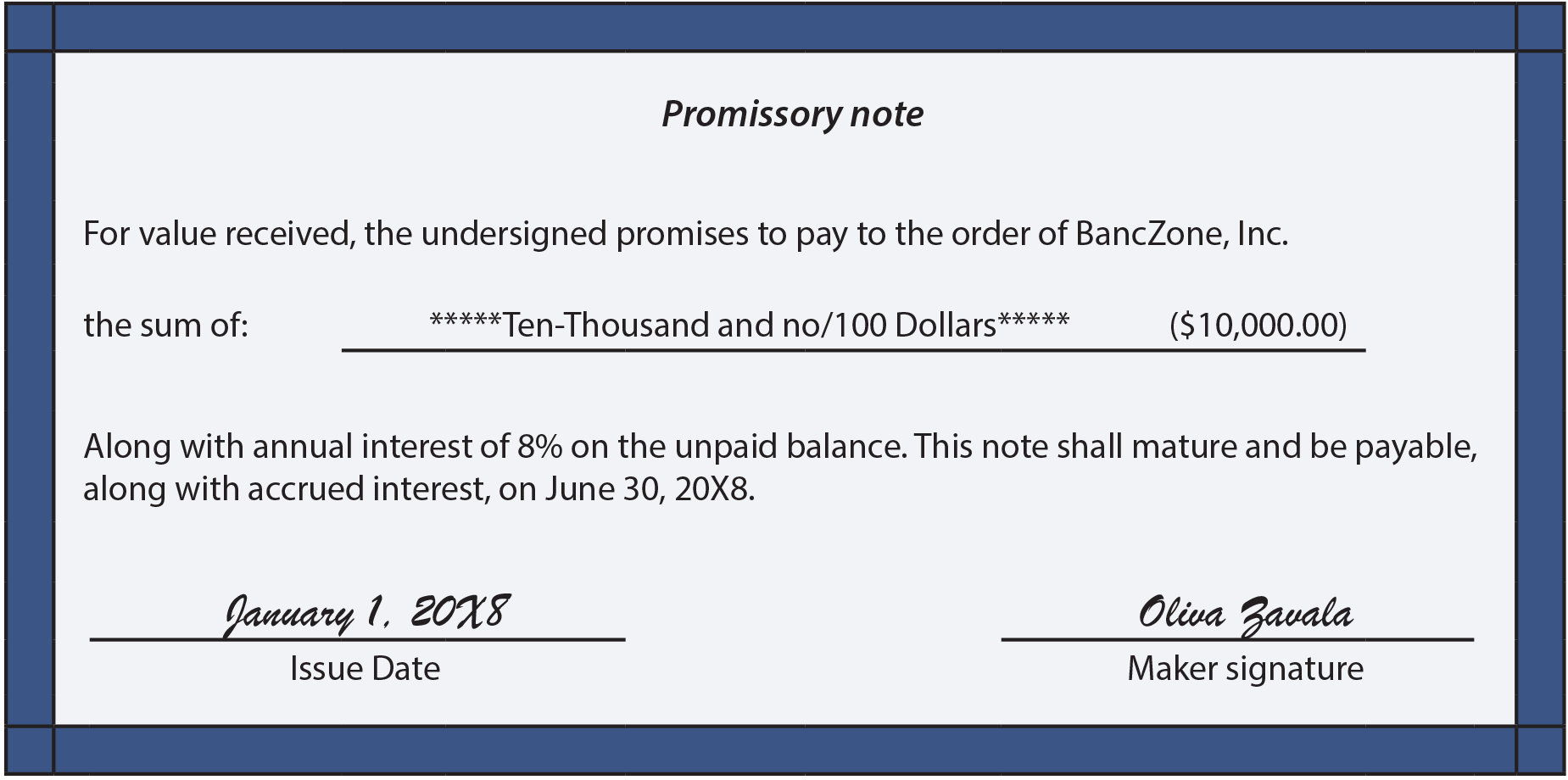

Pr x I X TP I or Principal amount x Interest rate x Time Period in months Interest. An Interest bearing account is a bank account in which the banks pays you an interest for keeping your money deposited in. Notes payable is a written promissory note that promises to pay a specified amount of money by a certain date.

Credit Notes Payable and Interest Expense C. Transcribed image text. Here is the formula.

When a company borrows money under a note payable it debits a cash account for the amount of cash received and credits a notes payable account to record the liability. Now we are going to borrow money that we must pay back later so we will have Notes Payable. A promissory note can be issued by the business receiving the loan or by a financial.

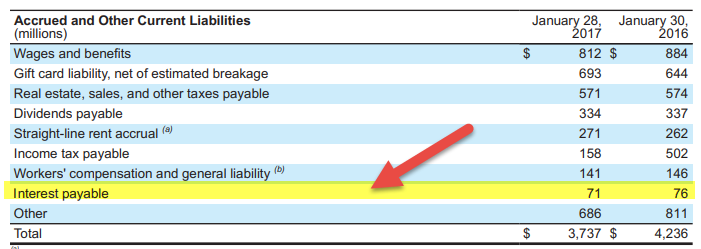

Interest Expense will be decreased O b. Interest payable accounts are commonly seen in bond instruments because a companys fiscal year end Fiscal Year FY A fiscal year FY is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual may not coincide with the payment dates. They will debit notes payable and interest expense.

It is because when not stable and interest are paid then entry will be Note Payable debit interest debit Cash. They will debit cash. They will debit cash.

1 When a corporation pays a note payable and interest. Long-term notes payable are due after a year. For example XYZ Company issued 12 bonds on January 1 2017 for.

When a corporation pays a note payable and interest the account interest expense will be decreased. Interest-bearing notes To receive short-term financing a company may issue. See answer 1 Best Answer.

The note has a 5 interest rate payable quarterly to the bank. Credit Notes Payable and Interest Expense C. If notes payable are due within 12 months it is considered as current to the balance sheet date and non-current if it is due after 12 months.

Interest Expense will be decreased O d. The account interest expense will be decreased. When a corporation pays a note payable and interest a.

They will debit cash. This is due to the interest expense is the type of expense that incurs through the passage of time. As the notes payable usually comes with the interest payment obligation the company needs to also account for the accrued interest at the period-end adjusting entry.

Debit notes payable and interest expense. Notes payable is a liability account where a borrower records a written promise to repay the lender. View the full answer.

When a corporation pays a note payable and interest Then correct selection will be d notes people will be decreased. They will debit notes payable and interest expense. When a corporation pays a note payable and interest Notes Payable and Interest Expense are both debited and Cash is credited.

On 21 When a corporation pays a note payable and interest ed out of question Select one. Debit notes payable and interest expense. In your notes payable account the record typically specifies the principal amount due date and interest.

Retained earnings service revenues common stock. The dual effect of each transaction is recorded with a debit and a credit. Notes Payable will be decreased d.

The account notes payable will be increased.

Interest Payable Definition Journal Entry Examples

Ch01 Solution W Kieso Ifrs 1st Edi

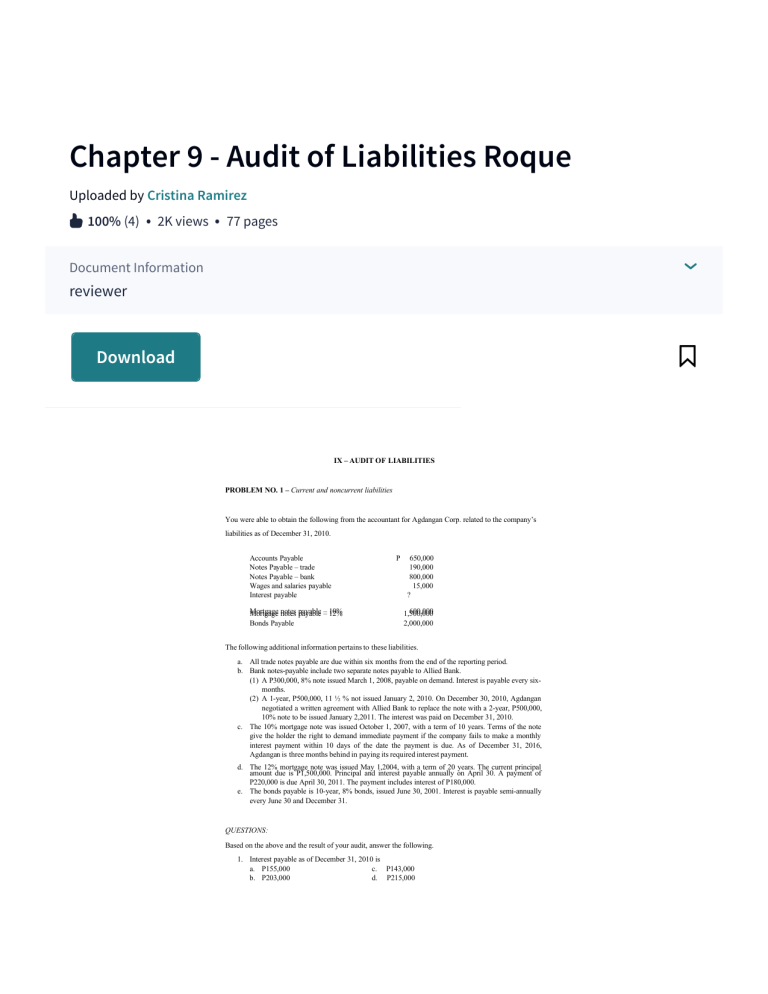

Toaz Info Chapter 9 Audit Of Liabilities Roque Bonds Finance Debits And Creditspd Pr 850666c5eb0c9c48d5d762ede28c7d81

Chapter 23 Statement Of Cash Flows Mc Computational Flashcards Quizlet

Ch01 Solution W Kieso Ifrs 1st Edi

Ch01 Solution W Kieso Ifrs 1st Edi

Chapter 3 E3 Lo 1 2 3 Yilmaz A S Encounters The Following Situations Identify The Type Studocu

Notes Payable Principlesofaccounting Com

Interest Payable Guide Examples Journal Entries For Interest Payable

Ch01 Solution W Kieso Ifrs 1st Edi

Chapter 3 Adjusting The Accounts

Accounts Payable Checklist Template Paying Bills Bill Pay Checklist Bill Payment Checklist

Comments

Post a Comment